Article Directory

The air around government payments often feels thick with rumor, a perpetual whisper of checks in the mail, or better yet, direct deposits landing in your account. For 2025, if you’re still holding your breath for a new federal stimulus payment, you can exhale. My analysis of the current landscape reveals a stark, unambiguous truth: there are no new federal stimulus checks authorized or planned for November 2025, or indeed, for the entirety of the year. Congress hasn’t moved an inch on new legislation for such payments. The last federal economic impact payments, those broad-brush infusions, were back in 2021. The deadline for claiming the 2021 Recovery Rebate Credit passed on April 15, 2025. That door is firmly shut. For more on the current status of stimulus payments, refer to Is a new stimulus payment coming? November 2025 IRS direct deposit fact check - KTVU.

The Digital Gauntlet and the Unseen Costs

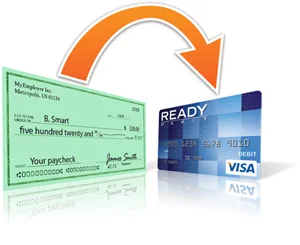

Now, while the federal spigot for broad stimulus remains closed, a different, equally impactful shift is underway, one that demands a closer look at the data. On March 25, 2025, President Trump issued Executive Order (EO) 14247, "Modernizing Payments To and From America’s Bank Account." This directive isn't about new money; it's about how you get the money you’re already owed, specifically tax refunds. The mandate is clear: federal agencies, including the IRS, are to transition all federal disbursements to electronic payments, with a hard stop on paper checks by September 30, 2025.

The IRS will begin implementing this for 2025 tax returns (those you’ll file in 2026). If you’re expecting a refund from your 2025 filing, you’ll need to provide direct deposit information. Fail to do so, or fail to qualify for an exception, and your refund will be held for six weeks after filing. The IRS intends to send you a letter, asking for bank details or guiding you to request an exception. Their "Where’s My Refund?" app, I’m told, will also direct you to provide bank information. This is where the rubber meets the road, or rather, where the digital highway bypasses a significant portion of the population.

The rationale for this move is simple, from an operational standpoint: efficiency and security. Paper processing historically causes delays, inefficiencies, and, critically, increases vulnerability to theft. Treasury checks are reportedly 16 times more likely to be lost, stolen, returned, or altered compared to electronic payments. From a purely numerical perspective, the IRS is attempting to streamline its pipeline.

But this push for digital efficiency carries its own set of problems, particularly for those on the margins. According to the FDIC’s 2023 report, 4.2% of U.S. households (approximately 5.6 million people) are unbanked. These are individuals without a checking or savings account. They don't have a digital on-ramp. While the IRS reports that around 94% of individual taxpayers already use direct deposit, to be precise, that's 94% of those who filed in 2025, not necessarily the entire eligible population, especially the vulnerable who might not file or have less stable financial lives. For the unbanked, this isn’t just an inconvenience; it’s a systemic barrier. EO 14247 does authorize exceptions for vulnerable groups—the unbanked, underbanked, disabled, Americans living abroad, victims of domestic violence, and those with deeply held religious beliefs. But the mechanism for these exceptions? A dedicated phone line where IRS assistors cannot receive bank account information for security reasons. I've reviewed enough government mandates to know that "additional guidance" and "dedicated phone lines" often mean "more questions than answers" and "longer wait times" for the average citizen, especially when dealing with a system in flux. It’s like building a high-speed digital highway while simultaneously dismantling the local roads for those who can't afford a car.

The Disappearing Safety Net

The irony, and perhaps the most significant structural flaw in this digital push, is the timing. As of October 1, 2025, the Taxpayer Advocate Service (TAS) offices nationwide are closed due to a lack of an approved federal budget. TAS is explicitly designed to assist taxpayers navigating complex IRS issues, exactly the kind of issues that will proliferate with a sweeping new electronic payment mandate, particularly for vulnerable populations needing exceptions. The very safety net meant to catch those falling through bureaucratic cracks has been pulled away just as the new, more complex tightrope is being strung. External stakeholders, from the American Bar Association to the National Taxpayer Advocate, have voiced concerns, emphasizing that modernization must be equitable. These concerns are echoed by the As the IRS Phases Out Paper Checks, Vulnerable Taxpayers Must Not Be Left Behind - Taxpayer Advocate Service (.gov). But without the TAS, who will ensure that equity? My analysis suggests a significant bottleneck for those needing assistance, leading to delayed refunds and increased frustration.

And it’s in this environment of confusion and shifting ground that the predators thrive. The IRS is actively warning taxpayers about scams using fake stimulus alerts via text, email, or social media. These fraudsters exploit the public’s perpetual hope for a windfall and their confusion over new IRS procedures. Law enforcement in Northern Virginia is already reporting stimulus check fraud cases. It’s a predictable outcome when information is fragmented and legitimate pathways are complicated. The viral posts claiming a $1,702 stimulus payment in October 2025 were, predictably, false, likely referencing Alaska’s Permanent Fund Dividend—a state program, not federal. The public’s hunger for good news, especially financial good news, makes them susceptible to even the most transparent fabrications.

The Digital Divide Deepens

The data paints a clear picture: the era of federal stimulus checks is over for the foreseeable future. What’s taking its place is a forced march towards digital payments, driven by efficiency metrics but potentially leaving millions behind. The IRS is modernizing, yes, but without a robust, accessible human support system, this "progress" risks exacerbating financial exclusion for the unbanked and vulnerable. The stated goals of efficiency and security are laudable, but without a truly equitable implementation strategy—especially with critical taxpayer services shuttered—the short-term operational gains will likely be overshadowed by significant human cost and systemic friction. It’s a classic case of a top-down mandate failing to fully account for the ground-level realities. The numbers don’t lie; the system is being redesigned, and not everyone is equipped for the upgrade.