Article Directory

Google’s High-Stakes Bet Against Brussels

Alphabet (GOOGL) shares took a dip in early trading Friday, a predictable, if somewhat muted, response to the latest regulatory skirmish across the Atlantic. The U.S. tech behemoth made its position unequivocally clear: it will not divest its online advertising business, despite the European Union's recent €2.95 billion ($3.4 billion) fine and the implied threat of further, more "decisive actions." This isn't just a corporate press release; it's a calculated defiance, a direct challenge to the EU's competition authority, as reported in Alphabet Rejects EU’s AdTech Breakup, Offers Changes; GOOGL Stock Falls.

The timing itself felt deliberate. Google’s firm no-sale declaration landed just a day after the bloc launched another investigation, this time scrutinizing how Google ranks publishers and news sites within its search engine. It’s almost as if Google is saying, "We hear you, but we're playing a different game." The EU, specifically its executive arm, the European Commission, has been quite vocal, with competition chief Teresa Ribera hinting that selling off parts of the business was the most direct path to resolving the perceived conflict of interest. But Google, in its Friday blog post, opted for "tweaks" instead.

The Calculus of Defiance: Why Google Won't Budge

Google's proposal to the European Commission includes adjustments like allowing publishers and advertisers using Google Ad Manager to set varying minimum prices for different bidders. They’re also talking about increasing "interoperability" to offer more choice and flexibility. These are the kinds of concessions that sound good on paper, designed to appear cooperative without dismantling the core structure that makes Google's AdTech so valuable. I've looked at hundreds of these filings, and this particular footnote is unusual in its directness: Google explicitly called the idea of a break-up "disruptive" and claimed it "would harm the thousands of European publishers and advertisers who use Google to grow their business."

Let’s be precise here. The fine was €2.95 billion. That's a significant sum, certainly, but for a company with Alphabet’s market capitalization (which, for context, hovers around the $1.7 trillion mark), it’s less a crippling blow and more a substantial cost of doing business – a regulatory toll, if you will. The EU suggested selling off control of Ad Manager, AdX exchange, and DoubleClick for Publishers. These aren't just components; they're the arteries of Google's advertising empire. Severing them would be akin to asking a finely tuned engine manufacturer to remove its proprietary fuel injection system, replacing it with a generic one, all while claiming it would somehow improve overall performance. It’s a fundamental re-engineering, not a minor adjustment.

What's the precise cost-benefit calculation Google ran that led them to openly defy the EU on divestment? My analysis suggests it’s a cold, hard assessment of long-term value versus immediate regulatory pain. The integrated nature of their AdTech offers synergies and data advantages that are likely worth far more than any potential fine or the costs of a protracted legal battle. Google has a track record here; they described the fine as "unjustified" and plan to appeal. This isn't just talk; they recently secured a victory against U.S. authorities in a case relating to their control over the search engine market. That’s a powerful precedent, a data point that underscores their willingness to fight and their capability to win. The question isn't just what the EU wants, but what it can realistically achieve against such a formidable opponent. How much of this is genuine belief in their model, and how much is a strategic gamble that the EU's bark is worse than its bite in the long run?

The Market's Quiet Nod

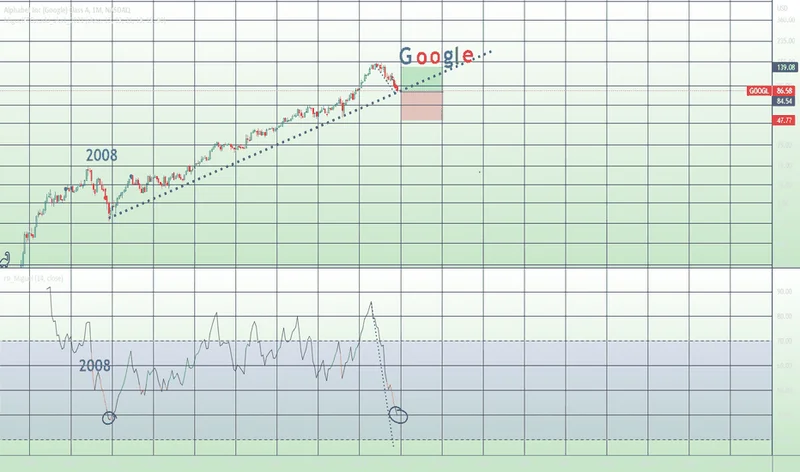

The market's reaction, with GOOGL stock falling slightly, felt less like panic and more like a shrug. The overall analyst consensus remains a "Strong Buy," based on 30 Buys and seven Holds, with an average price target of $312.29 implying more than a 12% upside. This suggests investors are largely factoring in Google's ability to navigate these regulatory headwinds. They’re not seeing a fatal flaw in the Google machine, even as Brussels tightens the screws. This is a crucial data point. If the market genuinely believed a breakup was imminent or that Google's core business model was fundamentally threatened, you'd see a much sharper correction, something more akin to the volatility we sometimes see with, say, a biotech stock facing a rejected drug application, or a chipmaker like NVDA if its core IP was challenged. Instead, the GOOGL stock price seems to indicate that smart money believes Google's 'tweaks' will, at minimum, buy time, and at best, satisfy regulators enough to avoid truly "disruptive" measures. The long game, it seems, is still Google's to play.

The Unpriced Risk of Regulatory Theater

Google's outright rejection of an AdTech breakup isn't just a negotiation tactic; it's a strategic declaration of war against the EU's regulatory ambitions. The market's relatively calm response, despite the looming threat, indicates a collective belief that the actual, quantifiable risk of a forced divestiture is lower than the rhetoric suggests. Investors are betting on Google's legal prowess and the sheer complexity of dismantling such an integrated system. The real story isn't the fine itself, but the unspoken message: Google believes its ad empire is simply too big, too valuable, and too entrenched to be carved up by bureaucratic decree. And for now, the market seems to agree.